Discovering the Perks of Offshore Trust Asset Defense for Your Wide Range

When it pertains to protecting your wealth, overseas counts on can offer substantial advantages that you might not have actually thought about. These trusts give a calculated layer of protection versus creditors and lawful insurance claims, while also boosting your personal privacy. Plus, they can open up doors to special investment possibilities. Interested regarding exactly how these advantages can affect your financial future and estate preparation? Allow's explore what offshore trust funds can do for you.

Recognizing Offshore Trusts: A Guide

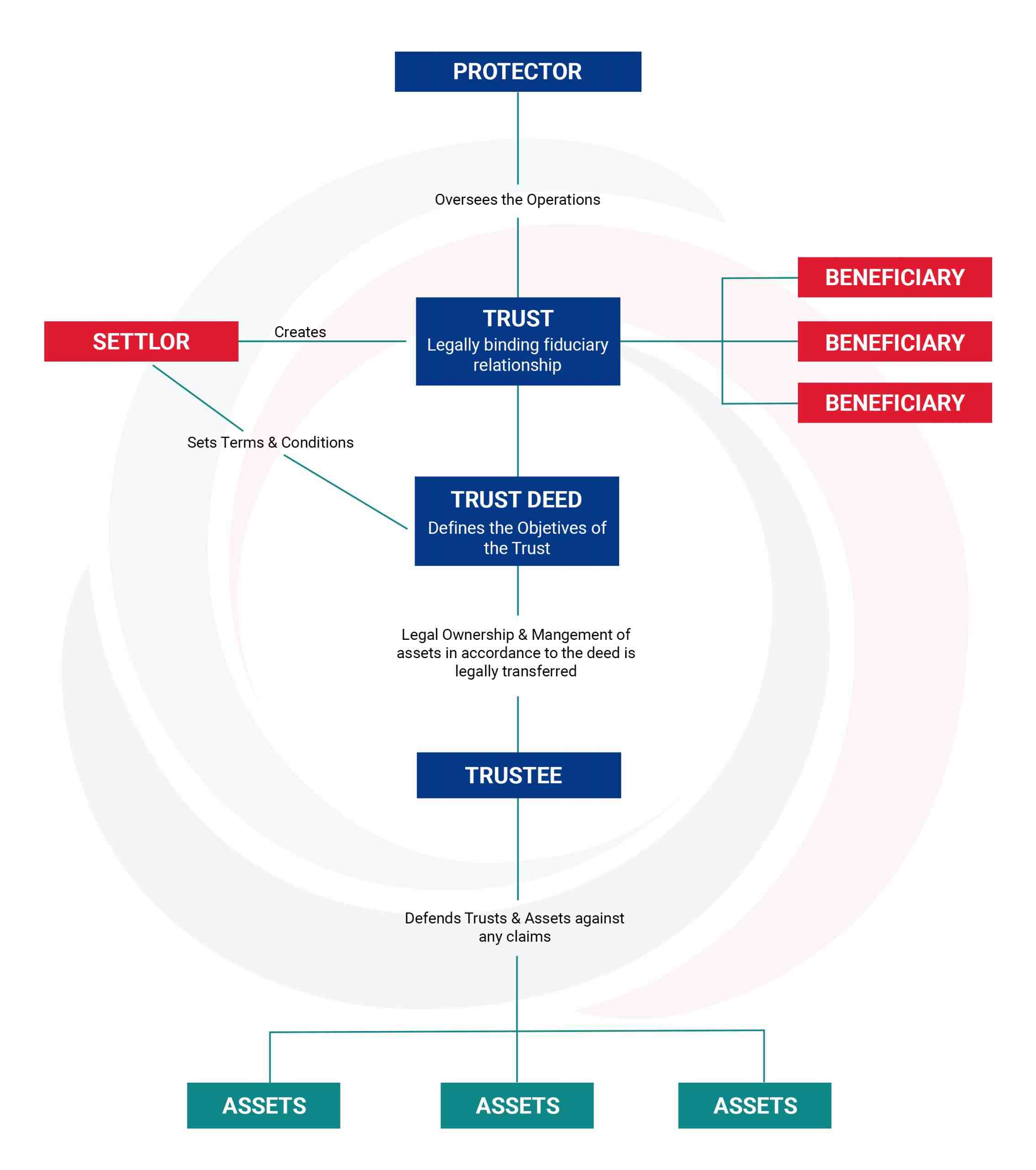

Offshore trusts offer an unique means to take care of and shield your assets, and understanding their basics is crucial. When you established up an overseas trust, you're essentially moving your properties to a trustee, who handles them according to your specified terms.

Furthermore, overseas trust funds usually provide privacy, securing your financial affairs from public analysis. By comprehending these principles, you can make enlightened decisions concerning whether an overseas depend on lines up with your property defense approach and long-term economic objectives.

Lawful Defenses Provided by Offshore Counts On

When you develop an offshore count on, you're tapping right into a durable framework of legal securities that can shield your assets from different threats. These counts on are typically governed by positive legislations in overseas territories, which can give more powerful defenses against lenders and lawful cases. Numerous offshore trusts profit from legal protections that make it challenging for financial institutions to access your properties, even in personal bankruptcy scenarios.

In addition, the splitting up of legal and helpful possession indicates that, as a beneficiary, you don't have direct control over the possessions, complicating any type of efforts by financial institutions to confiscate them. Many overseas jurisdictions also limit the moment framework in which declares can be made versus depends on, adding an additional layer of safety. By leveraging these lawful protections, you can substantially boost your economic security and safeguard your wide range from unanticipated dangers.

Privacy and Discretion Benefits

Developing an offshore trust not just supplies durable lawful securities however also ensures a high degree of personal privacy and confidentiality for your properties. When you established an offshore depend on, your monetary affairs are secured from public examination, helping you maintain discretion regarding your wealth. This confidentiality is necessary, particularly if you're worried regarding possible suits or unwanted interest.

In numerous overseas territories, regulations shield your personal details, indicating that your possessions and monetary dealings continue to be private. You will not need to stress over your name showing up in public documents or financial disclosures. Furthermore, functioning with a credible trustee makes sure that your details is managed safely, more enhancing your personal privacy.

This level of discretion allows you to handle your riches without concern of exposure, providing satisfaction as you secure your economic future. Inevitably, the privacy benefits of an offshore depend on can be a significant advantage in today's progressively clear world.

Tax Benefits of Offshore Trusts

Among the most engaging reasons to contemplate an overseas trust is the possibility for substantial tax obligation benefits. Setting up an overseas count on can assist you minimize your tax obligation responsibilities lawfully, relying on the territory you choose. Lots of offshore territories use beneficial tax obligation prices, and in many cases, you could also take advantage of tax exceptions on income created within the count on.

By moving assets to an overseas trust fund, you can separate your individual wealth from your gross income, which may reduce your general tax burden. Additionally, some territories have no resources gains tax obligation, enabling your financial investments to grow check my reference without the instant tax obligation implications you 'd encounter domestically.

Asset Diversification and Financial Investment Opportunities

By producing an overseas count on, you unlock to property diversity and one-of-a-kind financial investment opportunities that might not be offered in your home country. With an offshore depend on, you can access different international markets, allowing you to spend in realty, stocks, or products that could be limited or much less favorable locally. This global reach aids you spread risk throughout various economic climates and industries, shielding your wealth from local economic slumps.

Furthermore, overseas depends on commonly offer accessibility to specialized financial investment funds and different assets, such as private equity or bush funds, which may not be readily available in your home market. This critical approach can be crucial in protecting and growing your wealth over time.

Succession Preparation and Wide Range Transfer

When thinking about just how to pass on your wide range, an offshore trust fund can play an important function in reliable sequence preparation. By establishing one, you can ensure that your possessions are structured to provide for your liked ones while decreasing potential tax implications. An overseas trust fund allows you to dictate how and when your beneficiaries obtain their inheritance, providing you with assurance.

You can assign a trustee to take care of the count on, ensuring your wishes are executed also after you're gone (offshore trusts asset protection). This setup can additionally safeguard your properties from lenders and legal challenges, important source protecting your household's future. In addition, offshore depends on can provide privacy, keeping your monetary matters out of the public eye

Ultimately, with careful planning, an offshore trust can offer as a powerful device to promote wide range transfer, ensuring that your tradition is preserved and your enjoyed ones are dealt with according to your dreams.

Selecting the Right Territory for Your Offshore Trust Fund

Choosing the right territory for your offshore depend on is an essential consider maximizing its benefits. You'll intend to ponder aspects like lawful framework, tax obligation implications, and property defense regulations. Various jurisdictions use varying degrees of privacy and stability, so it is crucial to research each option completely.

Search for places recognized for their favorable trust fund regulations, such as the Cayman Islands, Bermuda, or Singapore. These jurisdictions frequently supply robust lawful securities and a track record for financial security.

Additionally, think about ease of access and the find out convenience of managing your trust fund from your home country. Consulting with a legal professional focused on offshore depends on can direct you in guiding with these complexities.

Inevitably, choosing the excellent territory can boost your property defense strategy and ensure your wealth is guarded for future generations. Make educated choices to protect your financial tradition.

Often Asked Inquiries

Can I Set up an Offshore Depend On Without an Attorney?

You can technically establish up an overseas depend on without a lawyer, but it's risky. You could miss out on crucial lawful subtleties, and problems can emerge. Hiring a professional guarantees your trust fund adheres to laws and protects your rate of interests.

What Happens if I Transfer To One More Nation?

Are Offshore Trusts Legal in My Nation?

You'll require to inspect your neighborhood legislations to determine if offshore counts on are legal in your nation. Rules differ widely, so consulting a lawful specialist can assist assure you make educated decisions concerning your assets.

Exactly How Are Offshore Trust Funds Controlled Internationally?

Offshore trust funds are regulated by international regulations and guidelines, differing by territory. You'll discover that each nation has its very own guidelines relating to taxes, reporting, and conformity, so it's vital to comprehend the specifics for your scenario.

Can I Accessibility My Possessions in an Offshore Count On?

Yes, you can access your properties in an offshore count on, however it depends on the count on's structure and terms. You ought to consult your trustee to understand the certain processes and any constraints involved.

Final thought

To sum up, overseas counts on can be a smart selection for securing your wide range. By providing lawful safeguards, personal privacy, and potential tax obligation advantages, they aid you protect your assets and prepare for the future. And also, the opportunity for diversity and international financial investments can boost your monetary growth. When thinking about an offshore trust, put in the time to select the best territory that lines up with your goals. With the right technique, you can genuinely guard your economic legacy - offshore trusts asset protection.